Tenant Manual Invoice Billing must be entered here.

Steps in creating a Tenant Manual Invoice Billing

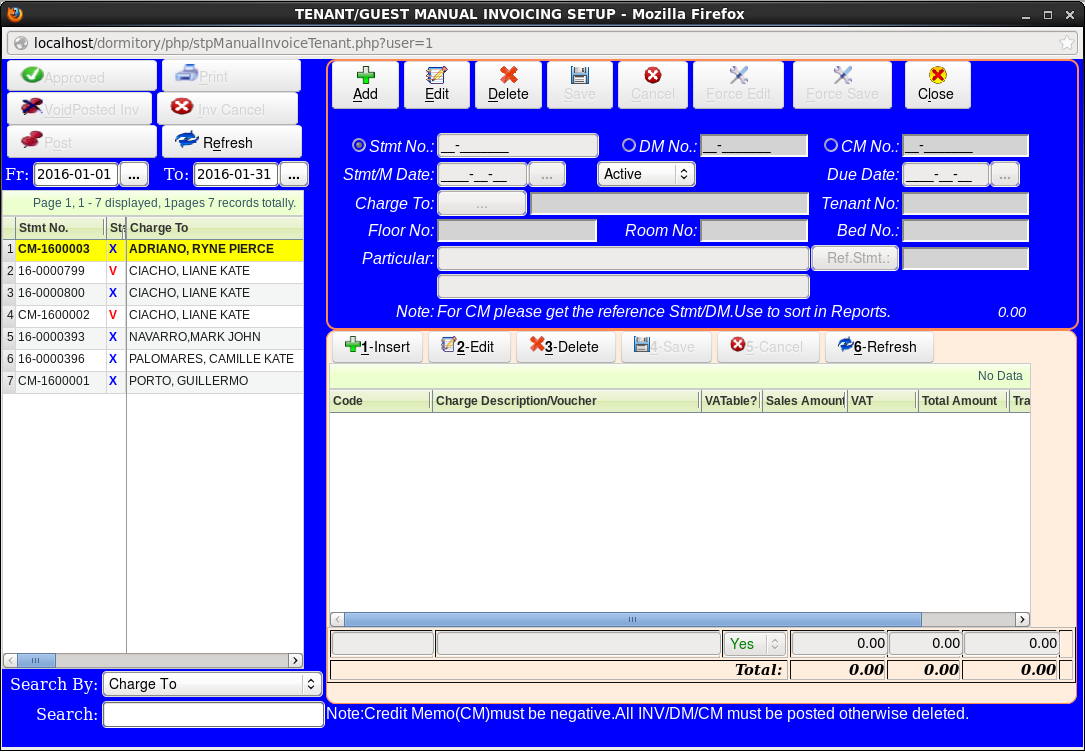

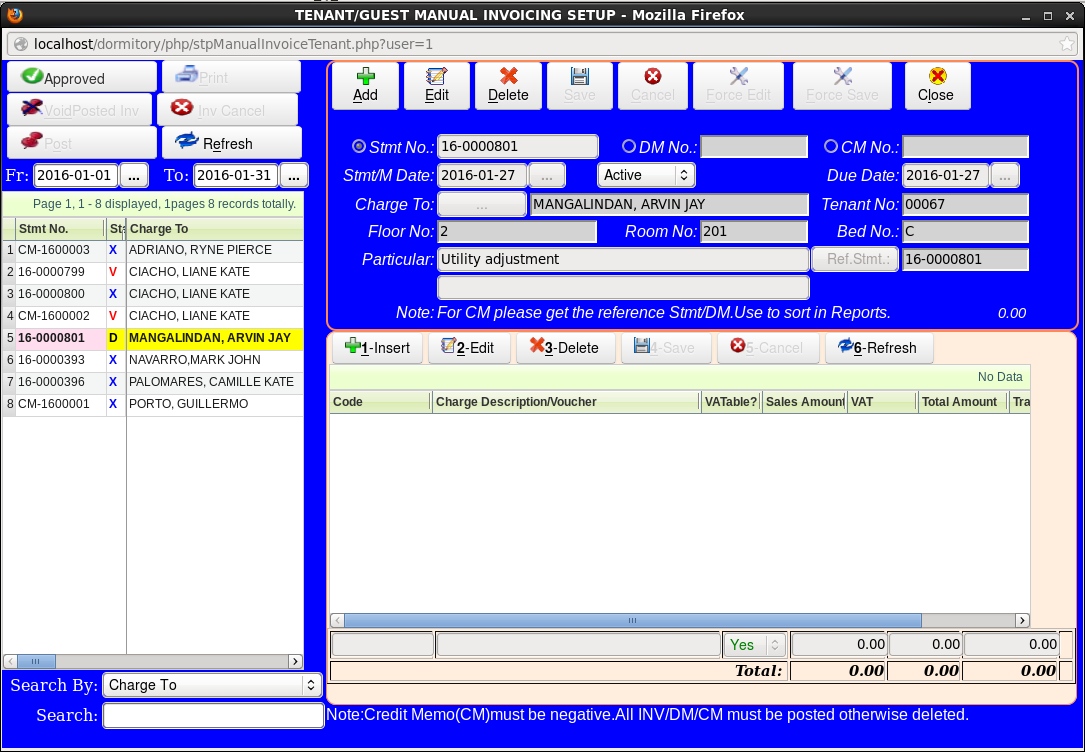

1. Click Add in the toolbar type button. After clicking Add button select a radio button if you want to create 1.Invoice/Statement, 2.Debit Memo "DM" , 3.Credit Memo "CM" Billing. The default is Invoice/Statement No. "Stmt No" . Stmt No., or DM No., and CM No. will be automatically generated by the system. See Figure below.

Also note, that the Fr: and To: date is very important because if after adding and the Stmt/M Date is out of range you cannot view that particular invoice/stmt/dm/cm. If in case it happened please edit the Fr: and To: date and click Refresh button. The default date for Fr: and To: date is the 1st and the last day of the current month.

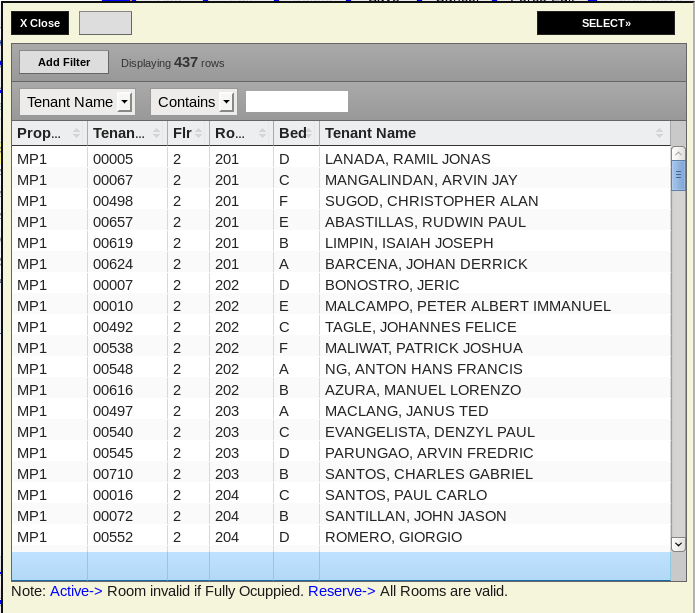

1.1. Now please select the status "In-Active,Active,Reserve, and Booked the default is Active" of the Tenant/Guest you are going to bill with an Advance/Deposit billing, then get a Guest/Tenant by clicking Charge To button. Figure below will appear;

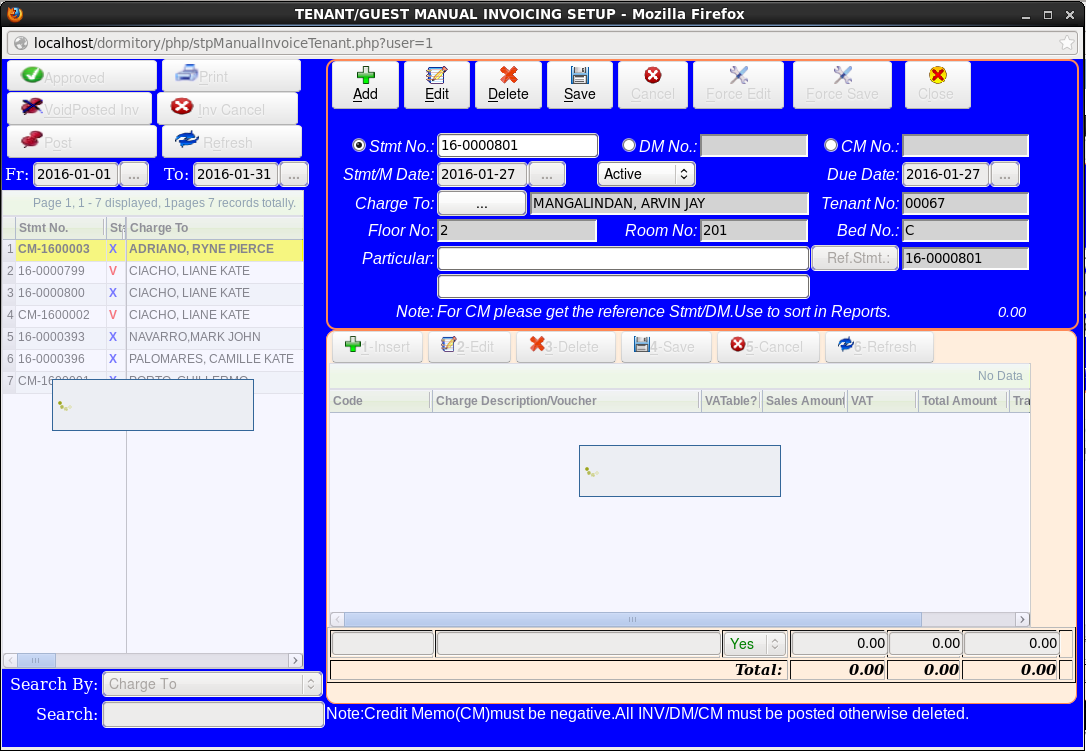

1.2. Here I selected MANGALINDAN, ARVIN JAY. You can double click mouse or just click SELECT button to select. See Figure below.

1.3. Please type in Particular. You can still Edit the Statement No before saving. Click Save in the toolbar type button. After saving invoice is created with a status D. See Figure below.

Billing using an invoice/statement is the same with Billing a DM. CM is also similar the only difference is it will ask a reference and the transaction details is in negative amount. The system have a trapping if no reference for CM. Statement and DM has a reference of it’s own.

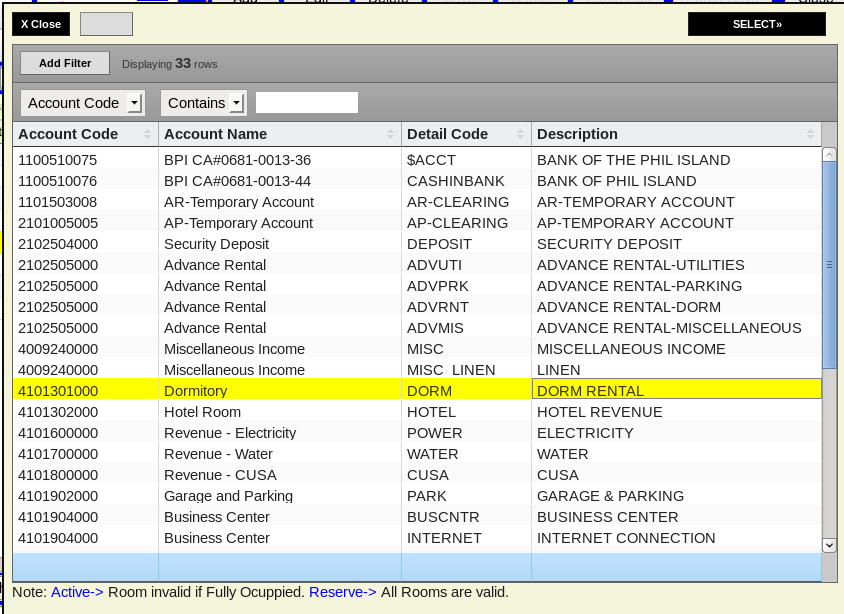

Now you can insert a billing by clicking 1-Insert button. If in case the 1-Insert button does not enable please click the specific invoice in the left Grid. Clicking insert will bring you to Account Code table. Here we will use DORM RENTAL account code. See Figure below.

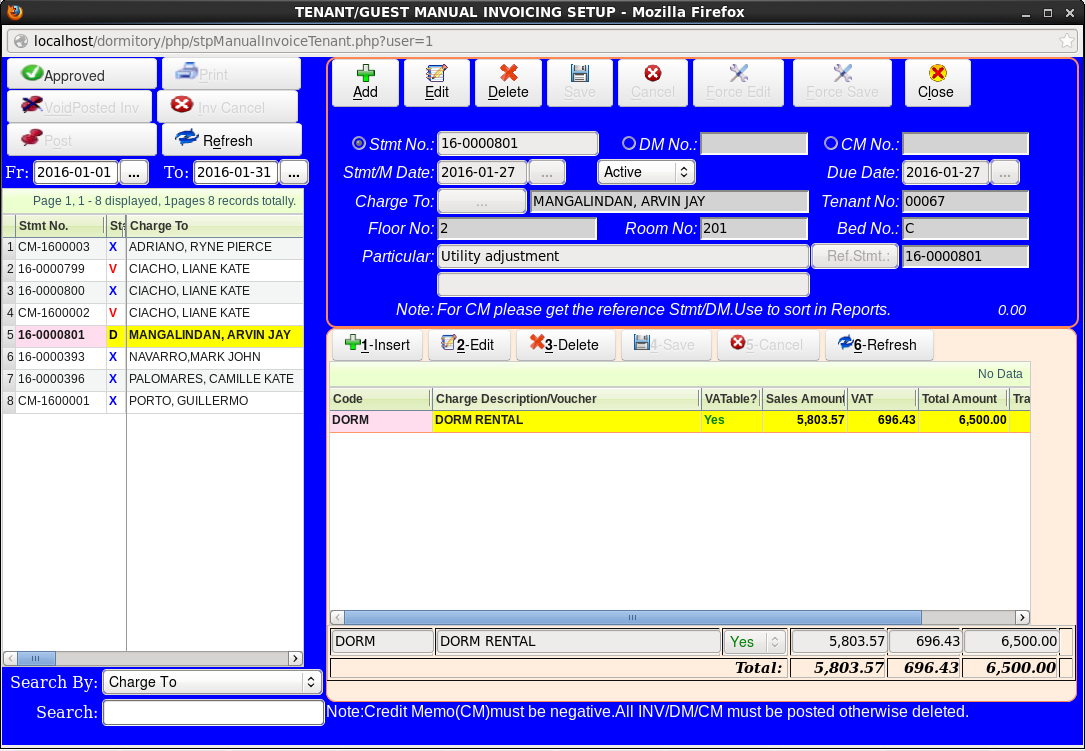

1.4. Type in the Total Amount, let say 6,500.00 in the lower right textbox and also notice that there is a combobox for taxable, depending on BIR ruling or tax exemption. Then click 4-Save button. See Figure below.

Six (6) types if Invoice Status.

1. Disapproved "D" - Disapproved status can still be edited.

2. Approved "A" - Approved status cannot be edited but you can still return to Disapproved.

3. Printed "P" - Printed status means it is already Printed.

4. Cancelled "C" - Cancellation of invoices/statements are in two ways. 1. Totally Cancel Invoice - cancelled invoice will zero out the amount. 2. Create New Invoice - Create a duplicate invoice with a status of "D" . The cancelled invoice will have a status of "C" and will auto create CM to reverse that invoice.

5. Posted "X" - Only Posted invoice can be paid.

6. Voided "V" - Void invoice will create an auto CM reversal.